Talati test 2022 is One of the Stylish Talati test Preparation Apps for profit Talati test Preparation 2022, Panchayat Talati test 2022, Online Reading Quiz And Examinations Bharti 2022, Jr. Clark Bharti 2022 and You can ameliorate your General knowledge, general mindfulness or easy medication for competitive examination any where with your mama lingo GUJARATI.

Talati bharti 2022 announcement, talati test accoutrements | online test medication

Talati Paper app for veritably useful for Talati cum Mantri test. in this app you got former papers for talati examination and also model paper that veritably useful for talati bharti test.

This Talati test App are Especially Made for Participents That are preparing for Talati cum Mantri test. This App Contains Details. That are Collected from Talati test expert persons and Institutions

Talati test 2022- Gujarati GK Preparation operation is Completely free. In this app we include all the syllabus of Talati test 2020.

Main Features :-

👉 Amazing stoner Interface and simple to use.

👉 Important GK notes in Gujarati.

👉 Content available in Gujarati without Internet.

👉 further than,000 questions for GK and current affairs

👉 History, English Grammar, Indian Law, Sports, Literature, Politics, Art & Culture and numerous further.

👉 Section wise fluently accessible questions.

👉 veritably useful for all competitive examination like CCC, PCS, UPSC, IAS, State Level PSC, RAS, SSC, PSU, GATE, PO, IBPS, GPSC, Bin Sachivalay Clerk, Revenue Talati, Police Constable, Gujarat Police Constable, Talati Mantri,etc.

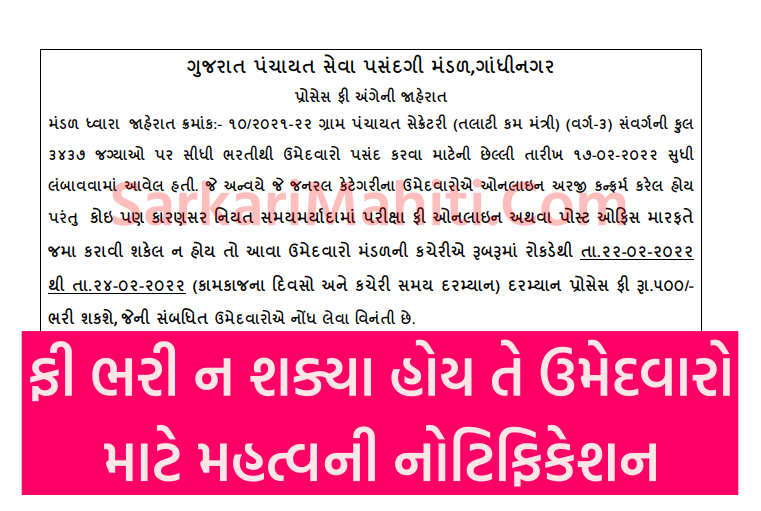

*તલાટીની પરીક્ષા માટે મહત્વનો નિર્ણય*

📕🎯

*🟣જેમણે પરીક્ષા આપવી છે તેમણે કંફર્મેશન આપવુ પડશે*

*🟣કંફર્મેશન નહી હોય તેવા ઉમેદવારો પરીક્ષા નહી આપી શકે*

*🟣તલાટી ની પરીક્ષામાં બેસનારા ઉમેદવારો માટે મોટા સમાચાર ..હવે પરીક્ષા 30મી એપ્રિલ નહીં પરંતુ 7 મેના રોજ લેવાશે.*

*🔴🆕💫તલાટી કમ મંત્રી ના ફોર્મ ભરવાની મુદતમાં વધારો*

અહીંથી જુઓ કઈ તારીખ થઈ

Talati Cum Mantri Syllabus : Click Here

તલાટી ભરતી નોટિફિકેશન અહીંથી જુઓ

Important

તલાટી પરીક્ષાનું તૈયાર મટેરીઅલ મેળવવા માટે અહી ક્લિક કરો

Science & Engineering – Top online courses in biology, deconstruction, life wisdom, chemistry, drugs, and colorful engineering courses including

A separate gate has been launched by the Government of Gujarat in the coming days for numerous replenishments in the Panchayat Department and to manage these replenishments duly.

A lot of skeleton replenishments are coming up in this section in the near future so this website will be veritably useful

official website in below address

http://gpssb.gujarat.gov.in/

Functions & Duties

The Gujarat Panchayat Service Selection Board is established under section 235 of the Gujarat Panchayat Act, 1993. The Board consists of five members including the Chairman.

The duty of the Board is to elect campaigners for reclamation to Class III posts in the Panchayat Service and to advise the Panchayats in similar matters as specified by the rules.

The Board also conduct Departmental Examination of Panchayat Service Class III and Hindi/ Gujarati Languages Examination.

The Board also advise panchayats for correctional action against panchayat service class III hand as per District Panchayat proffers in case of

Reduction in Rank

Compulsory Retirement

Removal from Service

Dismissal from Service

Reduction in Pension.

This website sub menu tital

Advertisements

Exam

Answer Key

Results

Provisional Merit List

Final Selection List

Departmental Exam

Hindi/Gujarati Languages Exam

Latest Update

લેબ ટેકનેશિયન ભરતી ની ઓફિસિયાલ જાહેરાત માટે અહી ક્લિક કરો

This website meny

લેબ ટેકનેશિયન ની જગ્યાઓ માટે અહી ક્લિક કરો

Recruitment Rules

નાયબ હિસાબનીશ ની નવી ભરતી 2022 માટે Click Here to download PDF

વિસ્તરણ અધિકારી ની નવી ભરતી 2022 માટે અહી ક્લિક કરો

Junior Clerk

Laboratory Technician

Live Stock Inspector

Mukhya Sevika

Multi Purpose Health Worker

Research Assistant

Social Welfare Inspector(Junior Grade)

Staff Nurse

Statistical Assistant

Old RR

Various recruitments by Gujarat Panchayat Service Selection Board, Gandhinagar.

Staff Nurse- Class-3.

Divisional Accountant - Class-3.

Extension Officer - Class-3 (Agriculture)

Deputy Accountant-Class-3

સ્ટાફ નર્સ ની નવી ભરતી 2022 માટે અહી ક્લિક કરો

ગુજરાત પંચાયત સેવા પસંદગી મંડળ બોર્ડ ની નવી વેબસાઈટ માટે અહી ક્લિક કરો

પંચાયત ની બધી જ નવી ભરતી 2022 માટે નો નવો અભ્યાસક્રમ માટે અહી ક્લિક કરો

પંચાયત ની નવી ભરતી ના નવા નિયમો 2022 માટે અહી ક્લિક કરો

Additional Assistant Engineer(Civil)

Accountant, Divisional Accountant, Internal Auditor

Compounder

Deputy Accountant

Deputy Chitnis

Extension Officer (Agriculture)

Extension Officer (Co-Operation)

Female Health Worker

Village Panchayat Secretary

Gram Sevak

Junior Clerk

તલાટી કમ મંત્રી ની નવી જાહેરાત 2022 માટે અહી ક્લિક કરો

Laboratory Technician

Live Stock Inspector

Mukhya Sevika

Multi Purpose Health Worker

Research Assistant

Social Welfare Inspector(Junior Grade)

Staff Nurse

Statistical Assistant

Old RR

Go to the website and for all the information

BASIC TIPS TO LEARN ENGLISH SPEAKING FAST:

Practice speaking English LIVE to learn English speaking

- Get native English- speaking musketeers and speak English with them

- Make miscalculations to learn English easily

- Learn some English lingo twisters

- hear to English- language music

- Learn new words diurnal

- Try thinking in English

- Record yourself speaking and have musketeers note

- Practice speaking English in front of a glass

- Master some specific expressions and English Expressions

- hear and try to sing along to rap music

See why we're one of the stylish English speaking apps for fluent English literacy & open English discussion practice! It’s truly an pleasurable and royal English literacy!

💡FEATURES:

● Speak in English Online Talk to the Real People anonymously without telling your identity & practice English discussion safely. With English listening, you can also boost your English talking.

● Tongue Twister Practice & study English Tongue Twister to ameliorate your pronunciation and make your communication clear

● Recall You can recall the favorite frequenter from your call history

● Basic English Grammar Learn English Grammar like tenses, speech

● English harkening Skill hear to the Native Speaker chronicling the discussion and Ameliorate your harkening Skill

● Basic Conversation Skill Read the most generally used discussion and try to apply

● Record Your Audio & Improvise Yourself while you speak in English and find the area of enhancement

● A Word a Day( Vocabulary) Strengthen your English Vocabulary by learning only One Word a Day. You can also see many exemplifications using the same word.

● Bookmark save any word as your fave for future reference

● Popular Expressions Use expressions in your discussion to make your communication more effective

● Pronunciation hear to the pronunciation of Vocabulary or enter any words for correct Pronunciation

● Take 30- day challenges we recommend you learn English speaking challenges to boost your English!

👉 Providing answer with all the questions.

👉 Offline & free app No need to internet connection after install the application Update regular interval in future.

Talati Exam 2022 - Gujarati GK Preparation

Talati Exam 2022 is One of the Best Talati Exam Preparation Apps for Revenue Talati Exam Preparation 2022, Panchayat Talati Exam 2022, Online Reading Quiz And Exams Bharti 2022, Jr. Clark Bharti 2022 and You can improve your General knowledge, general awareness or easy preparation for competitive examination any where with your mother tongue GUJARATI.

Talati bharti 2022 notification, talati exam materials | online exam preparation

Talati Paper app for very useful for Talati cum Mantri exam. in this app you got previous papers for talati examination and also model paper that very useful for talati bharti exam.

This Talati Exam App are Specially Made for Participents That are preparing for Talati cum Mantri exam. This App Contains Details. That are Collected from Talati Exam expert persons and Institutions

Talati Exam 2022- Gujarati GK Preparation application is Totally free. In this app we include all the syllabus of Talati Exam 2020.

Main Features :-

👉 Amazing User Interface and simple to use.

👉 Important GK notes in Gujarati.

👉 Content available in Gujarati without Internet.

👉 More than 10,000 questions for GK and current affairs

👉 History, English Grammar, Indian Law, Sports, Literature, Politics, Art & Culture and many more.

👉 Section wise easily understandable questions.

👉 Very useful for all competitive examination like CCC, PCS, UPSC, IAS, State Level PSC, RAS, SSC, PSU, GATE, PO, IBPS, GPSC, Bin Sachivalay Clerk, Revenue Talati, Police Constable, Gujarat Police Constable, Talati Mantri, etc.

The Gujarat Panchayat Service Selection Board is established under section 235 of the Gujarat Panchayat Act, 1993. The Board consists of five members including the Chairman.

The duty of the Board is to select candidates for recruitment to Class III posts in the Panchayat Service and to advise the Panchayats in such matters as prescribed by the rules.

The Board also conduct Departmental Examination of Panchayat Service Class III and Hindi/Gujarati Languages Examination.

The Board also advise panchayats for disciplinary action against panchayat service class III employee as per District Panchayat proposals in case of:

Various recruitments by Gujarat Panchayat Service Selection Board, Gandhinagar.

Staff Nurse- Class-3.

Divisional Accountant - Class-3.

See why we are one of the best English speaking apps for fluent English learning & open English conversation practice! It’s truly an enjoyable and effortless English learning!

👉 Providing answer with all the questions.

👉 Offline & free app No need to internet connection after install the application Update regular interval in future.